Compounding is the single most powerful force in wealth generation (Saving + Investment + Time = Wealth).

Angel investing allows you to diversify your portfolio with direct investment in businesses that could potentially generate outsized financial returns.

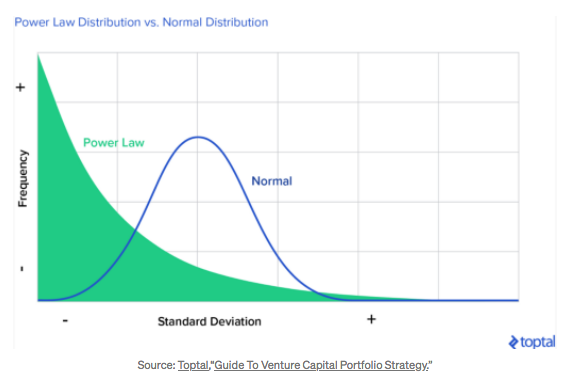

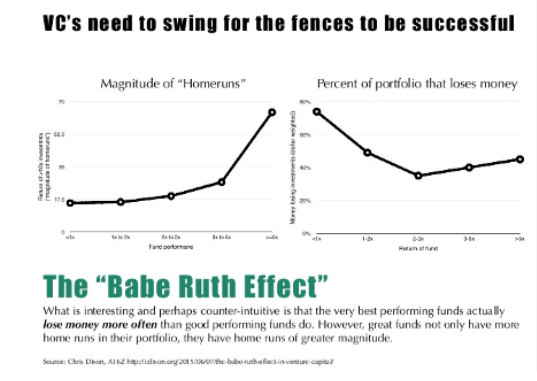

It’s not about the frequency of your wins and loses, but the magnitude of those wins and loses.

Do you know the single biggest factor that separates the most successful investors from everyone else? Furthermore, do you realize you have complete control over it?

You don’t need a PhD in mathematics or a degree in finance to understand the very simple formula that governs investment returns over time:

Saving + Investment + Time = Wealth

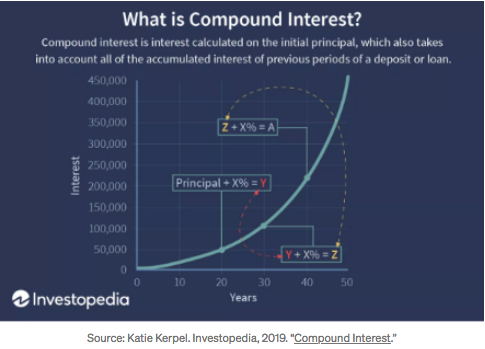

This equation works beautifully to generate wealth because of the power of compounding interest. The key here is that compounding interest is calculated based on the principal plus all of the accumulated interest from previous periods. It shouldn’t come as a surprise that the number of compounding periods makes an enormous difference (this point cannot be emphasized enough!).

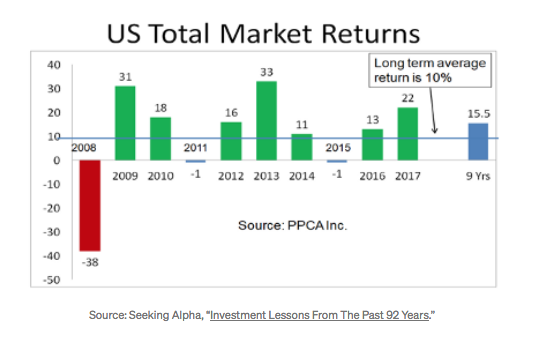

Let’s look at a quick example. The U.S. stock market has historically produced average annual returns of about 10%. If you annually compound your money at 10%, in 25 years you would realize a 10x return on your investment. So, if you invested $100,000, after 25 years of average returns, you’d be sitting on a cool $1,000,000.

But, what if your time horizon was 50 years? At a 10% annual return, this means you would realize a 100x return on your investment and turn $100,000 into $10,000,000 (all you parents and grandparents pay close attention)! So, the true power of compounding is not only having the financial discipline and resources to make the initial investment, but also having the time for it to bear substantial fruit.

As Warren Buffet is fond of saying, investing is simple, but not easy. While the formula for generating wealth is straightforward, the single most challenging aspect for most of us is having the discipline to stick with a long-term financial plan. It requires consistent investment, pay-check-after-pay-check, and the discipline to stay calm or even add to holdings when periods of volatility occur (whether it be a recession or a banking crisis or even a pandemic). Oftentimes, we are our own worst enemy when it comes to investing, selling our winners too early and holding our losers too long.

Yet compounding is only part of the equation.

Optimizing for Black Swans

What if you don’t have a 25 to 50-year time horizon or aren’t disciplined enough to stick with a long-term financial plan? Or, what if you’re simply impatient and would prefer to spend all of those future riches today?

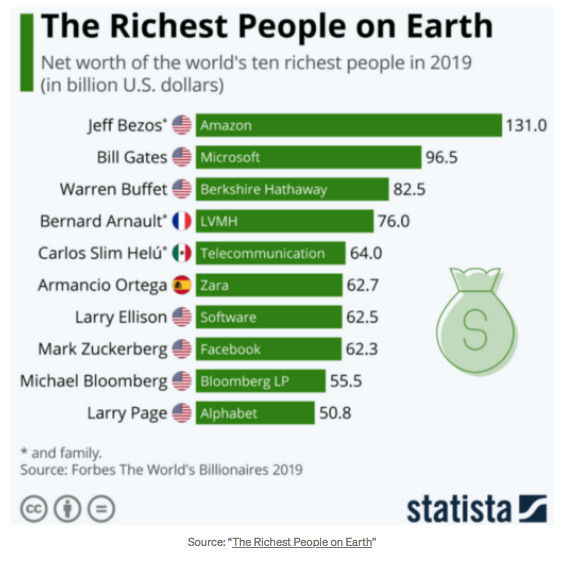

Take a moment to think about every person you’ve ever seen on the Forbes billionaire list… What is the one thing they all have in common? They are all business owners. They all started business empires that generated extreme wealth for themselves and their families.

Now, for a myriad of reasons, entrepreneurship isn’t for everyone. However, did you know there is another way to be a business owner and reap the same (or similar) rewards as the entrepreneurs who pour their blood, sweat, and tears into building their empires?

One of Charlie Munger’s core tenets emphasizes the fact that a share of stock is proportional ownership in the underlying business. Owning stock in businesses that have the potential to generate greatly enhanced financial returns can disproportionately increase the value of your portfolio.

You could do this by investing in the public markets, but as Meb Faber, Co-founder and Chief Investment Officer of Cambria Investment Management, says, “while power laws dominate both private and public markets, the lower starting point of angel investments with a $10 million market cap allows for a potential moonshot to occur perhaps more easily than a public stock trading at a $10 billion market cap.”

So why not take some of your hard-earned capital and invest it in other people who have great business ideas, increasing the odds your portfolio might experience positive black swan events (giving yourself a chance to receive extraordinary returns)? In other words, become an angel investor.

The Power of Mathematical Thinking: Frequency vs. Magnitude

When it comes to angel and venture capital-style investing, most people become preoccupied with the frequency of loss. It’s absolutely true the risks are higher when investing in the private markets and the likelihood of losing all the capital invested in any given startup is very real. But, it’s also true that the potential rewards from such investments are far greater too. When it comes to investing, risk and reward are opposite sides of the same coin. Riskier investments must offer the concrete probability of delivering superior rewards.

But, success in this realm hinges on one simple fact: it’s not about the frequency of your wins and losses, but the magnitude of those wins and losses.

As Babe himself said, “How to hit home runs: I swing as hard as I can, and I try to swing right through the ball… The harder you grip the bat, the more you can swing it through the ball, and the farther the ball will go. I swing big, with everything I’ve got. I hit big or I miss big.”

So, again, this comes down to a simple mathematical equation: the concept of expected value. In statistics and probability analysis, the expected value is calculated by multiplying each of the possible outcomes by the likelihood each outcome will occur, and then summing all of those values. By calculating the expected values, you can choose the scenario most likely to give the desired outcome (the highest positive expected value).

Expected Value = [Potential Reward x Probability of Occurring (a positive number)] + [Potential Loss x Probability of Occurring (a negative number)]

Let’s look at another example:

Let’s assume you’re considering a $25,000 investment in a startup and you assign a 90% probability of the startup failing (in-line with the base rate of startup failure). That’s the risk side of the equation and defines your potential loss. On the reward side of the equation, if there is a 90% chance of failure, you are assuming a 10% probability of success. Furthermore, let’s assume you believe this investment can generate a 10x return on your money, or $250,000. Then, the expected value of your investment is $2,500 [($250,000 x 10%) — ($25,000 x 90%)].

What if you assigned the probability outcome not as 10x, but 100x on your investment, making it a true outlier on the return distribution curve? Then, the expected value would be $227,500. Either way, theoretically, this would be a good investment because it has a positive expected value. Of course, it’s important to keep in mind this should be viewed as relative to the expected value of other available investment opportunities.

The key point here is that the expected outcome of winning your bet needs to be large enough to account for the higher probability of losing the bet. That’s why venture capitalists only invest in companies with enormous market opportunities and in business that can scale quickly. As an angel investor, you don’t have a $1 billion fund to return to limited partners and don’t necessarily need to generate a 100x return (although, of course, it would be nice).

We believe a well diversified portfolio of startups with a statistical probability of success is a smart way to enhance the return potential of your investment assets. You can dampen the effect of volatile public markets and invest in entrepreneurs and companies that you believe in. The higher risk, given proper portfolio construction and upside potential, should take care of itself. And, who knows, maybe you won’t have to wait 50 years to earn that $10,000,000 (but swing for the fence anyway).

— Neil Littman

Special thanks to Meb Faber, Co-founder and Chief Investment Officer of Cambria Investment Management, and his blog “The Get Rich Portfolio” for the inspiration and many of the examples in this piece.