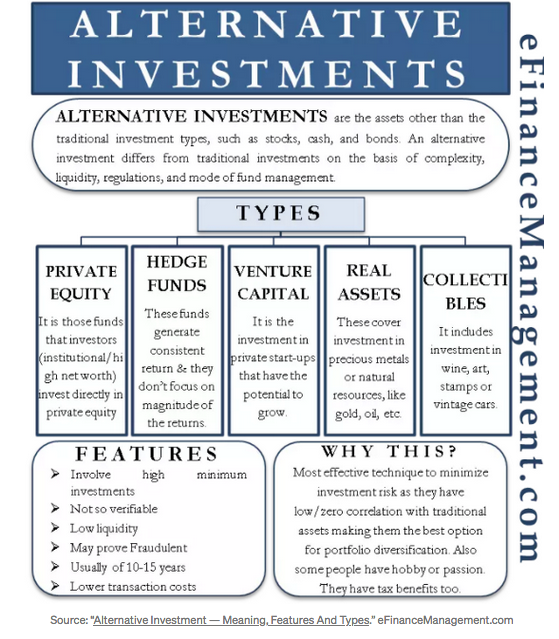

The world of investing has evolved, giving individuals new opportunities to invest in heretofore inaccessible, alternative assets. Individual investors can increasingly access private investment opportunities that were once the exclusive domain of institutional investors and high-net worth individuals.

While most of society tends to take little notice, there are powerful evolutionary shifts taking place within the investing world. At times, evolutionary change can happen quickly. But, it is, generally, a gradual series of adjustments that may be difficult to assess over shorter periods of time. Once a great shift has occurred, it is blatant. When it comes to allocating assets and gaining access to high-growth investment opportunities in private companies, things are evolving rapidly.

Evolution may be the single most powerful force in nature and the known universe. Evolution is a process where conditions are constantly changing and challenge the existing order of things. The extent that life and systems can adapt and thrive under new conditions is the measure of their success. Most changes will meet with failure and will fade from the scene.

The same evolutionary forces that govern genes and species also drive industries, organizations, products, etc. They all evolve to thrive in a particular environment or become obsolete. There are countless examples of entire industries and industry-leading companies that failed the challenges of new business environments. As a result, they experienced dramatic declines from their once iconic status (Kodak, Blockbuster, etc.). For a deeper understanding of corporate evolution and the traits necessary for successful adaptation to changing business climates, I highly recommend “Good to Great: Why Some Companies Make the Leap and Others Don’t” by Jim Collins.

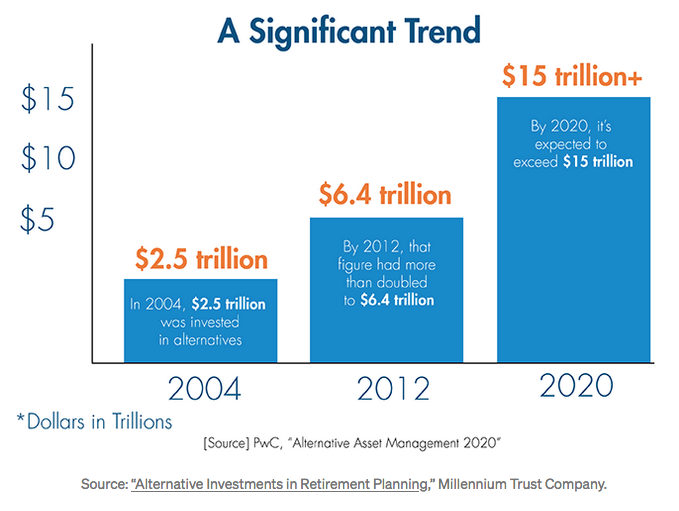

A Significant Trend

The speed and severity of change dictate both the rate of successful evolution and the rate of extinction. Under mild pressures, evolution can move very slowly and be barely perceptible. Other times, the pace of change rapidly shifts the landscape. For many generations, a Medieval farmer's life was basically the same. Since the Renaissance and the Industrial Revolution, every generation's lifestyle has been different from the one preceding it. And the pace is quickening.The point here is these fundamental evolutionary changes are also occurring today — right now, in fact — in the world of alternative investing.

Not very long ago, access to private companies was the strict domain of venture capitalists and ultra high net worth individuals. Those days are now gone, forever. There are now a myriad of online platforms that provide investors access to deal flow and the principals at private companies.

Due diligence is still crucial and there are certainly no promises, regarding the quality of the deals on these platforms. However, the point is they’re available to those who choose to make their own informed investment decisions. That’s evolution. A once inaccessible industry is evolving by opening its doors to us all.

I’ll share one brief example from our investment platform. Earlier this year, one of our portfolio companies, Blue Mesa Health, was acquired by Virgin Pulse. Blue Mesa Health built a Centers for Disease Control and Prevention (CDC)-recognized Diabetes Prevention Program (DPP). Blue Mesa’s product, Transform, is a Type 2 DPP that allows its members to more effectively manage their health and achieve sustained lifestyle change. While we can’t disclose the economics of the deal, we can, at least, say that it was a successful exit for investors.

New platforms are providing access to private companies and will continue to do so. Those platforms that deliver underperforming investments and substantial losses to their investors will, eventually, cease to exist. Those strategies will become extinct.

On the other hand, the platforms that provide lucrative investments to their investors will continue and even thrive. A few signature "grand slams" can cement a platform's reputation, attract capital, and establish its dominance. Unlike most sports, it’s not about the frequency of wins and losses that matters. It’s all about the magnitude of those wins and losses.

So, ask yourself one question: Is your portfolio evolving?

-Neil Littman