Angel investing is all about spotting potential in teams and companies.

Photo by Daria Nepriakhina on Unsplash

If you invested $US 10,000 in Facebook’s seed round in 2004, your money would have grown to over $US 250 million today. The same goes for many other companies, where a seed investment could yield a 100 fold return or more.

You hear all these stories about investors getting in early on startups that blow up, but how does all of this work? In recent years, loosening government regulations and new investing platforms have made angel investing more accessible than ever.

Basics of Startup Investing

Angel investing gives individuals the opportunity to fund very early-stage startups that are not yet ready to raise venture money. Typically, angel investments and seed rounds raise between $US 500,000 and $US 2,000,000 from a few people. You can invest either as an individual or join an angel group (the Angel Capital Association has a great list here).

The amount that is invested can be highly variable, based upon the investor’s and the startup’s needs.

VC Fundraising Journey (University Lab Partners)

In return for the investment, angels are given an early stake in a company. These shares can increase in value exponentially in future funding rounds, if the company becomes successful.

Traditionally, angel investors needed to be “accredited investors” (see SEC definition here), meaning that they have over $US 1,000,000 in investable assets or have an annual income over $US 200,000. However, under Title III of The Jobs Act, even if you don’t meet these requirements, you can now invest through a new breed of crowdfunding platforms.

Making Money through Angel Investing

While your company may grow in value over time, you, as an investor, can only make money through a “liquidity event” that allows investors and founders to cash out some or all of their shares. There are 2 main ways angels can make money:

- IPO (initial public offering): when a company is formally listed on a public exchange.

- Acquisitions: when a startup is acquired by a larger company, resulting in a payout to the startup investors.

When making investment decisions, keep these potential exit opportunities in mind.

Important Investing Terms to Know

- SAFE vs. Convertible Notes — A SAFE, which stands for “simple agreement for future equity,” was coined by Y Combinator. It is a warrant to enable investment in the first round. On the other hand, a Convertible Note is a form of debt that can convert to equity at a certain funding/valuation milestone. SAFEs are generally considered to be more founder-friendly than convertible notes.

- Priced rounds — Startups can also give the investor shares of the company in return for funding. There are usually two stock classes, common and preferred. The common stock usually goes to the founders. The preferred shares typically go to investors and usually come with perks, like getting paid back first when there is an exit

- Carry — Venture capitalists usually take a percentage of the payout profits in the form of a “carry.” For example, VCs lead the research, due diligence, logistics, and the investment in a startup. In return, they are typically compensated 20% of the profits (in addition to management fees). This vehicle is usually employed by those with considerable financial experience.

See more VC terms here.

Angel Investing Strategies

In his essays, the famous investor, Paul Graham, advises readers to not get hung up on the nuances of a deal — “When angels make a lot of money from a deal, it’s not because they invested at a valuation of $1.5 million instead of $3 million. It’s because the company was really successful.” Regardless of how much you invested in Snapchat a decade ago, you made incredible returns on your investment.

With that being said, how do you pick a great company?

Good market — Marc Andreesen famously said:

“When a great team meets a lousy market, market wins.

When a lousy team meets a great market, market wins.

When a great team meets a great market, something special happens.”

Essentially, market need is one of the biggest factors in startup success. If there is no widespread need for a product or service, even the best team will not be able to launch a successful startup. As a result, even seasoned entrepreneurs can raise billions in capital on an idea, but misjudge the prevailing market. The inevitable loss is painful for the investors (remember Quibi from early 2020?).

In fact, lack of product-market fit is the leading cause for all startup failures.

- Personal fit: Make sure that you invest in technologies that you already understand or can put time into understanding. With today’s pitch decks, buzz words are thrown around left and right. Having a real understanding of a startup’s core technology is essential to making a good investment decision. Also, angel investing isn’t just about picking the right companies. As an angel investor, you are often able to support these startups beyond just capital. Think about how you can personally bring value to the company.

- Exit opportunities: This was touched upon above, but think about how you can cash in on your investment. Is the startup a clear acquisition target for a larger company? Does the company have the potential to go public?

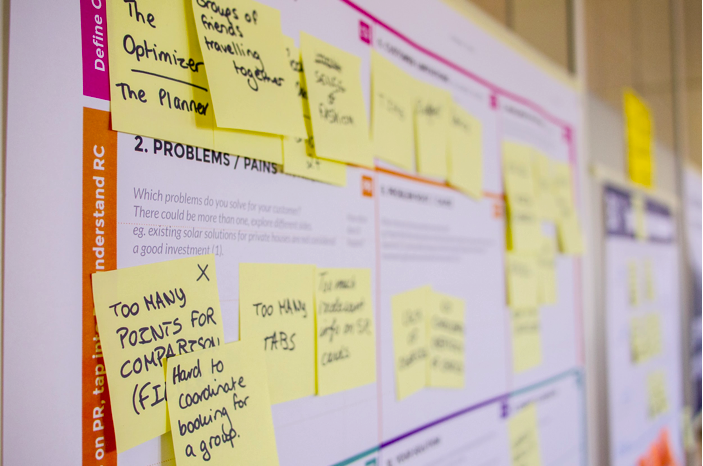

- Great team: Finally, the team also plays a crucial role in a startup’s success. As the saying goes, it’s not just the idea that counts, but the execution of that idea. Good things to look for in a team are diverse skill sets, strong technical background in the topic, previous entrepreneurial experience, and a boundless passion for the company.

Risks

As we mentioned in our blog on diversification, the majority of startups fail. However, when investing in startups, the magnitude of the outcome is more important than the frequency of your wins (please see our previous blog, Investing is Simple, Not Easy).

A general guideline in startup investing is that a small portion of investments will make up the majority of returns. As such, it is important to look for companies with the potential to become huge.

With early-stage startups, there is also much less information available about their finances and operations. This makes proper due diligence extremely important.

Other reasons to angel invest

Besides the possibility of getting in early on the next billion dollar company, angel investing gives investors the opportunity to work with passionate entrepreneurs, solving important issues. Since you get to work with the company in its youth, you can play a significant role in mentoring the startup and helping it grow.