You have probably heard, time and time again, to “diversify your portfolio” — this is to minimize overall risk and not put all your eggs in one basket. However, investing in early-stage startups, especially in healthcare, requires a slightly different approach.

Photo by Med Badr Chemmaoui on Unsplash

Venture capital differs from many other forms of investing because 90% of startups fail. Instead of counting on each investment to generate a somewhat reliable return, VCs make money by having a small number of outlier companies generate 10x-100x+ returns that compensate for failures across the rest of the portfolio.

Thus, venture capital investing focuses more on the potential upside of companies rather than minimizing loss and reducing risk. The structure of VC investments and the low startup success rate means that, in order to be profitable, each investment should have the potential to return your entire portfolio.

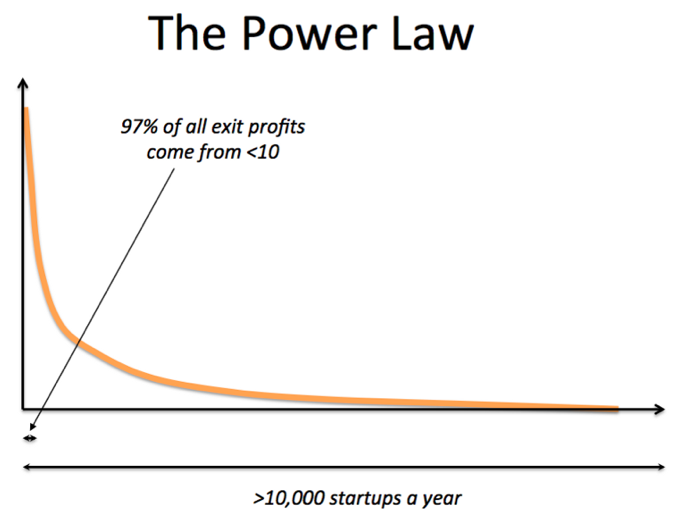

To better visualize the performance distribution of investments in a VC’s portfolio, please see the power curve, delineating investments and returns, below. When investing in early-stage startups, success follows a power curve rather than a normal distribution.

Power Law Curve (Contrary Capital)

This means that while there are many investments in startups, the majority of them either fail or generate very little return. Only a small percentage hit a home run. Even the most successful VCs (think your Y Combinators and Sequoias) lose money on the majority of their investments. Because of this, quantity is important.

The current problem with many investors, new to venture-style investing, is their failure to keep this philosophy in mind. They end up investing in one or two small startups, see them fail, and decide to not continue. If a farmer plants only a few seeds and they all fail to germinate, she may starve. If she plants many seeds and just a few plants live to produce a bountiful crop, she’ll keep farming.

In healthcare, there are stringent regulatory guidelines and, oftentimes, companies must go through several rounds of testing and approval before bringing a product to market. While it takes a long time for approval, most approved drugs will be patent protected for a decade or more, allowing the company to have a monopoly over a space.

AbbVie’s poster drug, Humira, is an excellent example. This autoimmune treatment has generated over $115 billion in revenue since 2010 thanks to its 13-year patent (that expired in 2016). Keep in mind that the $115 billion is just for a single drug, not the entire company. Despite the hurdles that startups need to overcome, the innovative technologies and treatments these companies create impact hundreds of thousands of people.

So how can you diversify within healthcare? While a digital health startup and a company developing a new therapeutic to cure pancreatic cancer both fall under “healthcare,” they are still vastly different. Healthcare and life sciences span a wide range of sectors, from drug development to telehealth to biomedical devices. Most of the new startups are looking for seed or Series A funding. The chart below outlines a few different areas of healthcare and provides examples of successful startups in those spaces:

By having a portfolio diversified across different areas of healthcare, you are able to ensure that your investments are exposed to a broad pool of potential innovation and rapid growth.

For example, the telehealth industry, accelerated by the pandemic, has an estimated CAGR of 25.2% until 2027. The broader global digital health market is also growing at a CAGR of 28.5% over a similar time frame. This is significantly outperforming some other sectors in healthcare and the general healthcare market overall. When you diversify across healthcare, you have a higher chance of hitting a home run with one industry, even if some others are less successful.

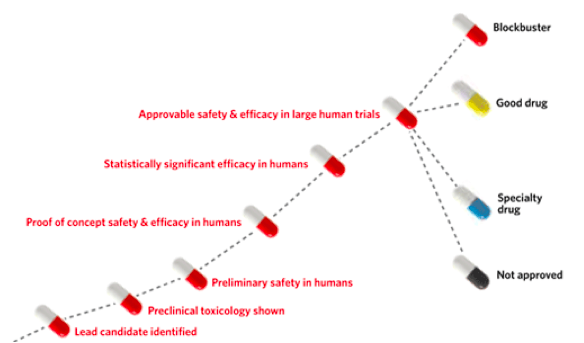

You can also diversify across different stages of development. This is particularly relevant to pharmaceutical startups. Drug development can be segmented into the following categories: 1) Discovery, 2) Preclinical, 3) Clinical, and 4) Commercial. The following diagram visualizes the drug development process and possible outcome.

Detailing the Biotech Life Cycle (The Scientist)

Investing in the discovery and preclinical phases comes with more risk because there are many regulatory challenges the drug must surmount. However, well-researched investments at these earlier stages allow you to invest at a much better valuation than if you were to invest once the company’s drugs have reached the market. Still, investing in more established companies greatly reduces the risks associated with investing in early-stage startups.

In the end, your decision, regarding how you want to structure your portfolio, is a personal one. You can choose to allocate your investments across these different areas and stages based on your personal expertise and risk tolerance — just make sure to keep in mind the unique nature of startup investing.