Clearly, the world has changed. The global financial markets have experienced extreme volatility, during the Covid-19 pandemic. Since the SARS-CoV-2 virus first appeared and even as the vaccines against it are currently being distributed, our collective attention has shifted to worldwide health and well-being.

The pandemic boldly accentuates the reasons we set out to build our online, healthcare focused, venture capital platform in the first place. We seek to source, invest, and democratize access to emerging, disruptive healthcare companies that will save lives, create value, and make the world a better place. As Benjamin Franklin first said in the late 18th Century, we can all "do well by doing good."

The Evolving Landscape

We’ve witnessed a fundamental shift in the way people invest and allocate assets. Index investing, via low-cost exchange-traded funds (ETFs), has enabled individual investors to create well-diversified global portfolios of stock and bond funds with ease.

In 2019, U.S. ETFs accumulated a record $4 trillion in assets under management. At the beginning of the 21st Century, ETFs, collectively, had less than $100 billion under management. With the advent of a new generation of “robo-advisors,” you can largely put this style of investing on auto-pilot at a relatively low cost.

But that is only part of the story.

Two Roads (Markets) Diverged

Although this is beginning to change, many public market valuations have declined due to the current, pandemic driven, economic situation. Many new companies are staying private longer usual, giving individual investors less access to them during the most dramatic phases of their growth.

What this means is that “ordinary investors” (you and me) have been prevented from benefiting from the wealth creation associated with the earliest stages of this hyper-growth. Reed Hoffman has named this accelerated growth phase “blitzscaling.”

Here's an example:

Uber. There’s no question Uber has experienced a challenging tenure in the public markets, having, at one point, lost over a third of its value since the IPO. The ride-hailing firm went public on 05/10/19 at $45 a share and, as of this writing, has clawed its way back up to that level. The IPO was when us “ordinary investors” finally had the chance to invest in Uber. And if you did? Well, you went on a spectacular roller coaster ride.

But guess who’s not complaining?

Investors who participated in Uber’s seed round realized a cash-on-cash return of nearly 5,000 times when the IPO debuted at $45. So, if you had invested $10,000 in Uber’s seed round, the value of your investment at the time of the IPO would have been $50 million!

Uber’s seed deal will go down as one of the greatest venture-capital investments of all-time — even when compared with the early bets on Google, Facebook and startups from the dot-com boom (Source: Uber Jackpot: Inside One of the Greatest Startup Investments of All Time).

Of course, as an “ordinary investor,” you never had the opportunity to invest until the IPO.

Let’s take a look at less dramatic and less well-known example.

Orchard Therapeutics. Orchard is a commercial-stage biotech company dedicated to transforming the lives of patients with rare diseases through innovative gene therapies.

Here’s a quick look at the company’s financing trajectory:

- Series A (2016): Raised $33.4 million (company valuation not disclosed)

- Series B (2017): Raised $110 million (company valuation not disclosed)

- IPO (2018): Raised $200 million at $1.2 billion market cap

Based on data compiled from SEC filings, Series A investors stood to make ~14x return in under three years (not accounting for the effects of dilution and assuming they liquidated their shares after the lock-up period expired). The company priced their IPO at $14.00 per share on 11/02/18 and, as of this writing, is trading somewhere north of $5. Ordinary investors who got in on their IPO are still waiting to see a profit.

If you had invested $10,000 in the Series A offering, the value of your investment at the time of the IPO would have been $140,000. Not exactly Uber returns, but those are stellar returns for the best VCs (especially given a compressed timeline of less than 3 years from Series A to IPO). Even at today's market price, your Series A investment would be worth over $50,000. A $10,000 investment at the IPO price would be worth less than $4,000.

So, how can you participate in early, seed round investments?

What’s the Secret?

Give yourself the chance to invest in private companies that have the potential to generate outsized returns as part of your overall portfolio. It's that simple.

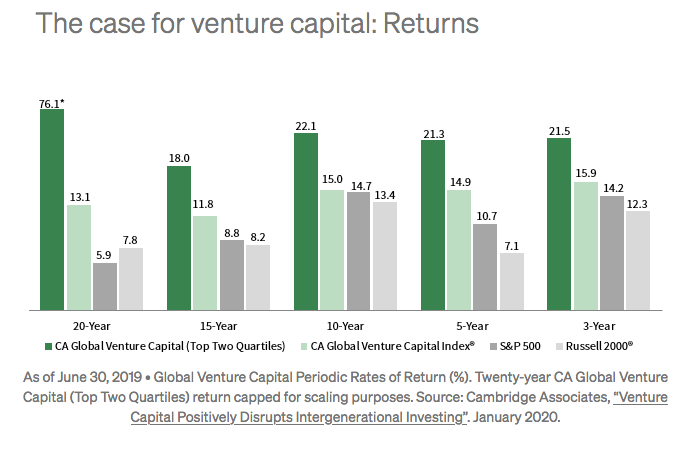

There’s a lot of conflicting information on the benefits and returns associated with the VC asset class. But a recent analysis by Cambridge Associates shows the numbers are very clear: there is not a single period of time where the VC index underperformed the public markets.

This isn’t a new concept, it’s been validated by institutional money managers for decades. But, now, it’s accessible for us ordinary investors.

Institutional Money Validates Alternative Assets

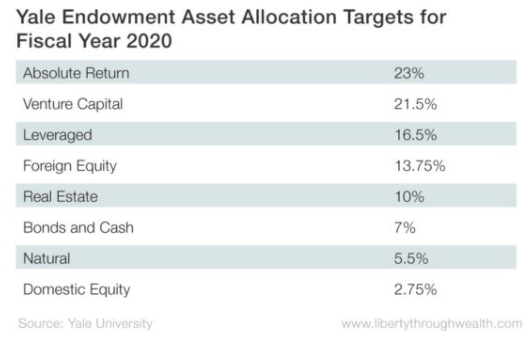

Yale’s endowment fund — one of the largest at $30.3 billion assets under management — generated returns of 12.6% annually over the past 30 years and added an incredible $32.7 billion of incremental value.

How, on Earth, did they do this?

They did it, in part, by having >50% of their endowment invested in alternative assets (with 21.5% invested in venture capital).

The Yale endowment fund was one of the first to apply Modern Portfolio Theory to managing a multibillion-dollar endowment. While there is a broad misconception that 90 percent of returns come solely from asset allocation (it's actually closer to 40 percent), asset allocation remains a critically important piece of the investment process.

Since the object of investing is to increase returns while decreasing risk, the answer becomes clear. Alternative assets are generally uncorrelated with public markets (or at least have minimal correlation). So, by investing in a range of asset classes beyond traditional stocks and bonds, you can construct a portfolio that generates higher returns with lower risk.

Yale shifted the bulk of its investments into alternative assets, including sizable allocations to natural resources, venture capital, real estate, and foreign stocks.

While this approach works great for a behemoth like Yale, what can we, as individual investors, learn? As it turns out, we can learn an awful lot.

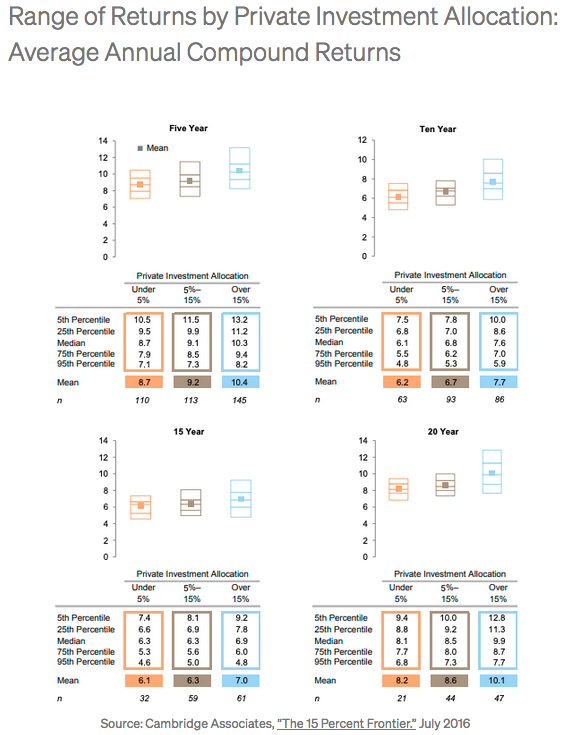

Given the personal cash flow needs of everyday life (mortgage payments, college tuition, etc.), allocating 50% of your portfolio to alternative assets isn’t recommended or feasible for most of us. However, another analysis by Cambridge Associates shows a clear “15% Frontier” when it comes to investing in alternative assets. They discovered this “15% Frontier” was not only consistent, but persisted across various time horizons.

Investors with this level of private allocation consistently generate greater returns over over 5, 10, 15 and 20 year periods. Over a 20 year period, the return for institutions with >15% allocated to private investment was almost triple the return generated by those with a typical, <5%, private investment allocation. The data clearly demonstrate the potential for enhancing returns by incorporating alternative assets in well diversified portfolio.

While allocation to alternative investments is clearly advantageous, specific individual risk tolerance and cash flow requirements cannot be ignored.

This is precisely where discipline comes into play. Figure out what portfolio allocation works best for you, be disciplined enough to stick with it for the long-term, and don’t be swayed by the latest investment fad or hype. That doesn’t mean being inflexible in your approach. But, it does require establishing long-term goals and constructing a portfolio that has a high statistical probability of meeting those goals.

Evolution in Action: Power Laws within Power Laws?

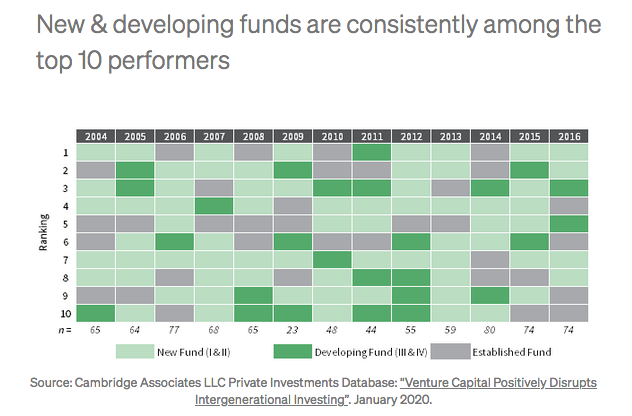

There’s another broad misconception worth addressing when it comes to investing in VC as an asset class. It is widely believed that, even if an individual investor wanted to allocate funds to venture capital, there is simply no way to gain access to the top performing funds. People think only bottom-quartile firms (with relatively bleak prospects) are available to them.

Again, contrary to popular opinion, the data show this simply isn’t true. As the following analysis demonstrates, “new and developing fund managers consistently rank as some of the best performers.”

The data are saying that you don’t necessarily need to be in the largest funds and biggest names to generate outsized returns for your portfolio. Furthermore, there is a serious VC “math problem” larger funds encounter as they scale beyond a certain size (e.g. funds need a greater number of larger exits as they scale).

In 2019, U.S. VCs invested a total of $136.5 billion in U.S. in 10,777 deals. Although those number sound large, they aren’t, when put into context. in 2017, over 300,000 accredited investors participated in 23,000 deals (Reg D), raising over $1 trillion. Those 300,000 investors represent just a fraction of the more than 20 million accredited households in the U.S.

Furthermore, Alto IRA estimates that, when combined with the 110 million non-accredited households, there is roughly $24 TRILLION socked away in U.S. savings accounts.

Just as ETFs ushered in a new era for public market investors, new and developing fund managers are leveling the playing field for the VC asset class, giving Main Street investors access to these new and potentially lucrative opportunities.

Make a Difference While Making a Return on Capital

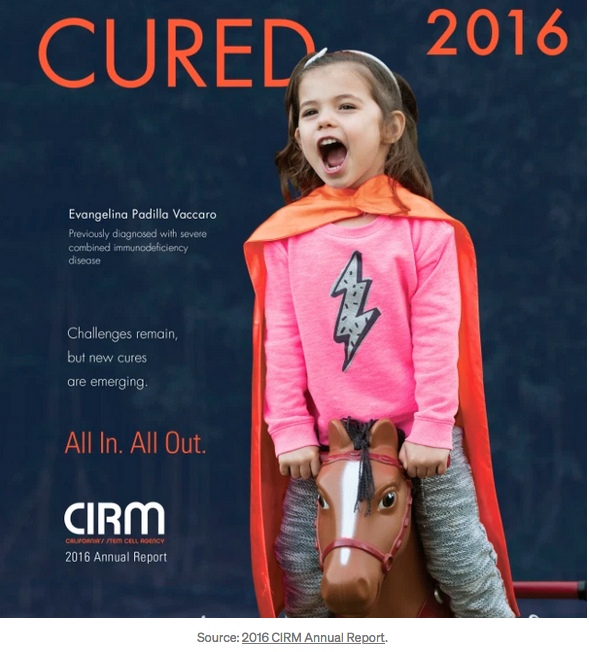

I’ll leave you with one final thought. Remember the Orchard Therapeutics example? Well, early stage investors not only made a great return in under 3 years, but they also furnished critical funding for the technology that cured 29 children with Severe Combined Immunodeficiency. One of those children, named Evie, is not only alive, but thriving. She now lives a normal life, going to school, surfing waves at the beach, and playing with her dog.

“Evie is my little genetically modified supergirl”

-Alyssa V., Evie’s mother

So, when critics condescendingly tell you that, as an individual, you have no business investing in private companies or in the venture capital asset class (as they’ve told me time and time again), just point to Evie and say, "Really?!"

-Neil Littman