>> Presenting the VC 101 Whitepaper

Introduction to Healthcare Venture Capital

Venture Capital 101: What is it?

Venture capital (VC) refers to a form of private equity financing that is provided to startups or early-stage companies with high growth potential. Venture capital firms provide funding to entrepreneurs and companies with innovative ideas or promising products or services, in the hope of generating a high return on investment (ROI). In return for their investment, VCs typically receive equity in the company, which they hope to sell for a profit when the company goes public or is acquired by another company.

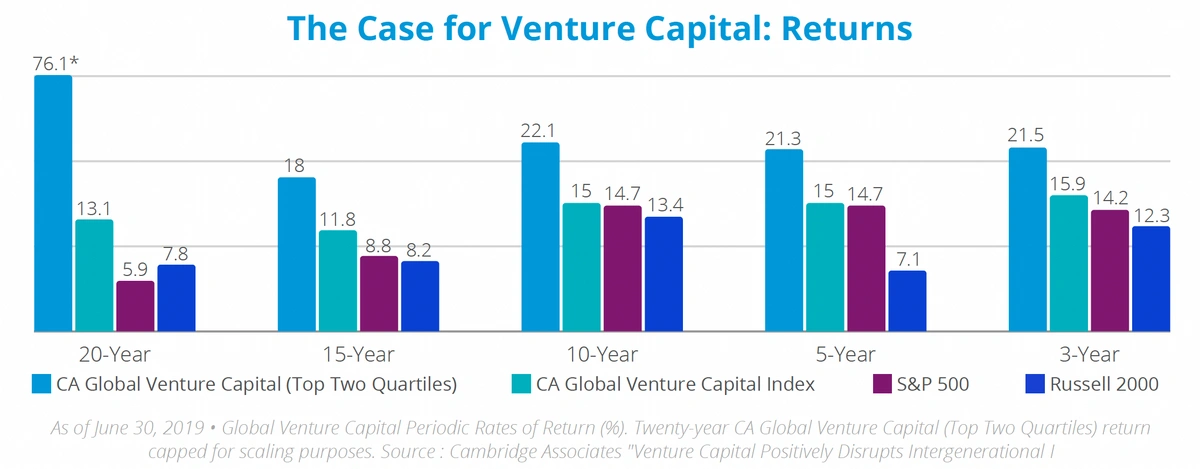

In general, VCs seek an internal rate of return (IRR) of at least 20% or higher for their investments, which is significantly higher than the average returns generated by other asset classes, such as stocks or bonds.

The VC asset class has now cemented its place as one of the best ways to capitalize on both innovation and disruption and for the risk-willing investor, the rewards can be far greater when compared with other private market investments.

By its very nature, early stage VC investment fuels innovation and economic growth. VC investment means simultaneously capturing the broad set of next-generation structural trends while staying at the forefront of innovation. In the long run, this can also act as a diversifier against more traditional business and market declines.